Introduction to Crypto Exchanges

The third key development in the growing world of crypto is the platforms where people can buy, sell and trade their cryptocurrencies. These platforms are called crypto exchanges. Crypto exchanges come primarily in two flavours: centralised (CEX), and decentralised (DEX). Each of these have their advantages and disadvantages, illustrating a lot about the world of digital currencies and the ways in which new technologies will shape how we all interact in the future.

What is a Centralized Crypto Exchange?

A centralised crypto exchange is a service which manages trades for its users. In this case, a centralised organisation would act as an intermediary between a buyer and a seller. It would provide services such as order matching, custody and asset storage (think Coinbase, Binance, Kucoin, Kraken and the like). Just like traditional stock markets, centralised crypto exchanges provide a user-friendly interface, a wide selection of assets, and more advanced trading features, such as futures and margin trading.

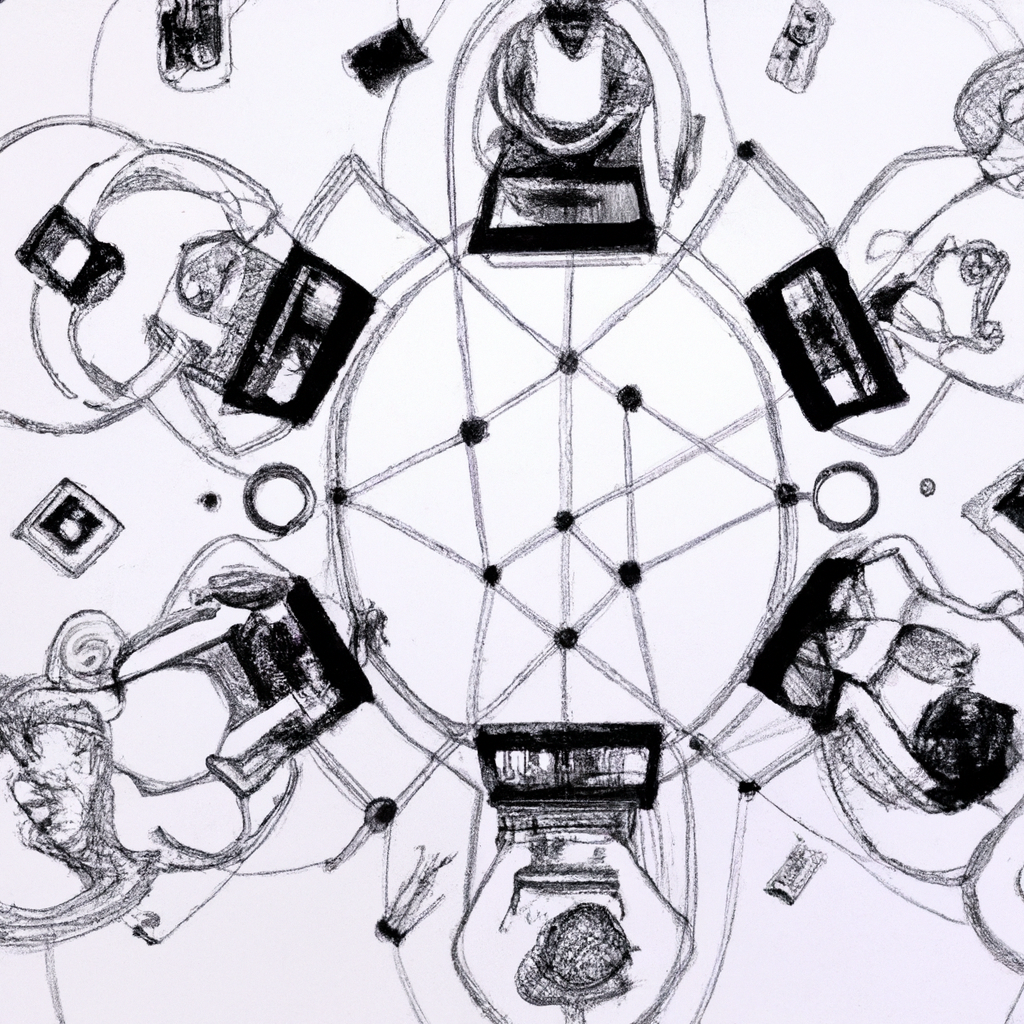

What is a Decentralized Crypto Exchange?

At the other, a decentralised exchange, with no centralised third party, allows for a peer-to-peer trade driven by an automated protocol, overseen by smart contracts (eg, Uniswap, SushiSwap, PancakeSwap). These decentralised exchanges promote trustlessness (meaning that users themselves control private keys to their funds).

Comparing Security Aspects

Security is a priority for both centralised and decentralised exchanges but each handles it differently. Centralised exchanges are common targets for hackers, who know they can find a large amount of users’ funds in the equivalent of one bank. Still, they generally have robust security (such as two-factor authentication, encryption or cold storage).

Decentralised exchanges, in contrast, let people keep control of their private keys – so there’s no need to transfer assets from a wallet to the exchange before trading, nor does their movement need to be monitored by it. Unlike centralised exchanges, DEXs are more likely to be theft-proof in the event of a hack. But the flipside is that they’re more vulnerable to smart contract risk.

Usability and Accessibility

For inexperienced users, centralised exchanges are often more accessible (they offer customer support and interfaces with limited complexity), and they provide a fiat-to-crypto bridge, potentially making the entrance into the crypto-sphere less intimidating for non-technical beginners.

The downside of decentralised exchanges is they have steeper learning curves and tend to require a more in-depth knowledge of blockchain technology, whereas more mainstream centralised exchanges might support fiat currency transactions – essential, particularly for novices.

Liquidity and Trading Volume

On centralised exchanges, which have greater trade volume, liquidity is also typically higher, as more people will be participating in the orders.^{[2]} Besides allowing assets to be bought and sold more quickly, higher liquidity also leads to more competitive prices and lower incidences of price slippage.

Historically, decentralised exchanges have always been lacking in liquidity, though that gap is becoming much tighter as more traders embrace liquidity pools and other mechanisms designed to incentivise users to add liquidity to the exchange.

The Evolution of Crypto Exchanges

At first, all crypto exchanges were centralised. Immediately after Bitcoin’s release in 2009, platforms like Mt. Gox sprang up and quickly became the behemoths until their spectacular collapse in 2014 exposed the hazards of centralised exchanges. They piqued interest in alternatives.

The development of the world’s first smart contract platform, Ethereum, enabled the first DEXs, while the ongoing decentralisation of the industry at large, in addition to the importance placed on privacy and security by users, has taken the creation of new platforms to a whole new level – and this is just the beginning.

Conclusion

However, when it comes down to it, choosing between a CEX or a DEX will come down to what the user values most: the usability and liquidity of a centralised exchange, or the security and autonomy of a decentralised one. As the crypto market matures, it wouldn’t be surprising to see more innovations arise in both forms of exchange. Perhaps the market will even gravitate towards a middle ground that combines the best features of CEXs and DEXs. All in all, it’s an important distinction to know about for anyone interested in using cryptocurrencies.