This is important because the integration of technology in finance shows no signs of slowing down, and smart contracts are set to play a prominent role in how financial services of the future will be done. This blog post will explore the role of smart contracts in modern finance, as well as some of their applications.

Understanding Smart Contracts

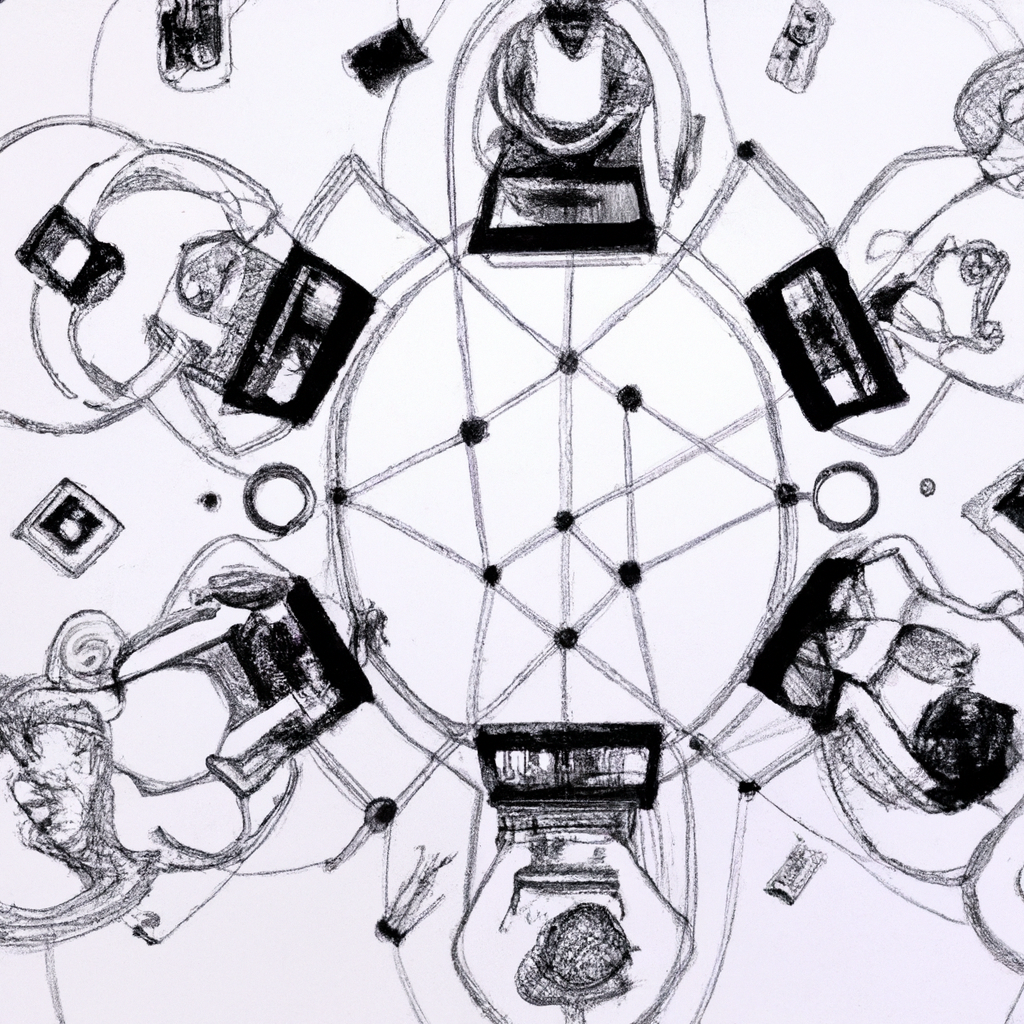

Smart contracts are automated – encoded – contracts that execute among crowds via blockchain, where the terms of the contract are contained in lines of code and live on a distributed, decentralised blockchain network, which can simultaneously validate transactions transparently. Smart contracts artificially execute a contract based on stored if-then conditions, which removes third parties and reduces the element of fraud in human-based transactions.

Impact on Financial Services

The idea is for smart contracts to automate our financial transactions and services, so as to reduce operational costs and increase speed and certainty. Third parties and intermediaries would become less necessary. The process would also become less expensive, more tamper-proof and more transparent (although not completely – not any contracts).

Applications in Modern Finance

It can be expressed in legal language, computer code, or a combination of the two. Smart contracts are emerging as a core component of modern financial ecosystems, applicable to simple as well as sophisticated transactions:

- Banking: In banking, for example, smart contracts can be used to automate routine tasks like processing payments or issuing letters of credit. They can also facilitate faster and more secure transactions.

- Insurance: Smart contracts enable automation of claim processing in the insurance industry. They can verify claims and pay out accordingly, eliminating processing time and the possibility of errors or fake claims.

Real estate: smart contracts enable real estate transactions through automating the sale of property, reducing the need for paperwork and the likelihood of fraud.

- Supply Chain Finance: Through the use of smart contracts, supply chains can be made more transparent by showing where goods or products are at any given time in the supply chain, and allow for payments to be automated at different stages of the supply chain process.

Challenges and Considerations

There are numerous issues and caveats surrounding smart contracts that should make us take a deep breath before embarking on a hasty transition to them. Jurisdictional differences concerning legal recognition and regulation will hamper adoption. While smart contracts seem to offer a way to minimise ‘alignment costs’, they might introduce new denting-cost risks arising from coding or design flaws.

Future Prospects

Smart contracts might finally be here to stay. As new industries see the potential for the technology, and as the technology improves, there are good reasons to believe that smart contracts will find an increasing number of use cases in finance. Enhancements to blockchain technology and clarifications of legal grey areas may allow for more sophisticated and agreed-upon applications in finance.

Ultimately, smart contracts are poised to completely reshape how we think about and approach financial services, by eliminating costly human overheads, minimising security vulnerabilities, and empowering us all to free up our time and mental energy to pursue other endeavours. As the rollout of smart contracts continues, we’ll undoubtedly witness freshly explored ways to deploy these automated contracts. It won’t be too long before we start interacting with them on a daily basis.